BIDEN BUDGET PROPOSAL 2024

March 20, 2023

President Biden’s 2024 Budget Proposals for Tax Reform

– A Debt Ceiling Showdown is in the Works –

President Biden’s tax reform measures are intended to tax the wealthy and corporations to cover the cost of various Democrat Party initiatives, such as increased spending on affordable housing, funding preschool initiatives, Pell grants to students going to historically Black colleges and other minority institutions, and expansion of Medicaid. The Tax Foundation calculates that these tax increase would reduce the budget by $2.8 trillion, but only if the extension of the favorable tax cuts offered under President Trump’s 2017 Tax Cuts and Jobs Act that will expire in 2025 are not extended. This means the budget assumes the reduction of the estate, gift, and generation skipping exemptions are cut in half (50% reduction) in 2026. As such, the present administration is not proposing to extend those tax reduction benefits after 2025. The proposals were met with a demand by Republicans to reduce spending and to refrain from raising taxes before they are willing to lift the debt ceiling. The odds are some compromise will occur, but who they negatively affect is not certain. As a result, those with taxable estates should take head and consider measures to preposition assets and planning alternatives that may be removed under this proposed tax reform and the reduction of exemptions in 2026. Some of those are discussed below, after a brief summary of some of the proposals that may affect the largest number of our clients.

It is worth noting at the outset, that although the proposals increase various income taxes, they do not seek to increase estate, gift, or generation skipping tax rates or reduce the lifetime exemption, which is $12.92 million in 2023. As such, and in general, the same planning that has been recommended to prepare for reduction in 2026 remains, with certain caveats mentioned in this Client Alert. See Back to Square One!-

https://kempelaw.com/wp-content/uploads/2022/01/Newsletter-Winter-2022.pdf

Income Tax Proposals

The following reflects an abbreviated summary of the most relevant income tax proposals that may affect the majority of our clients, and the year in which effected:

-

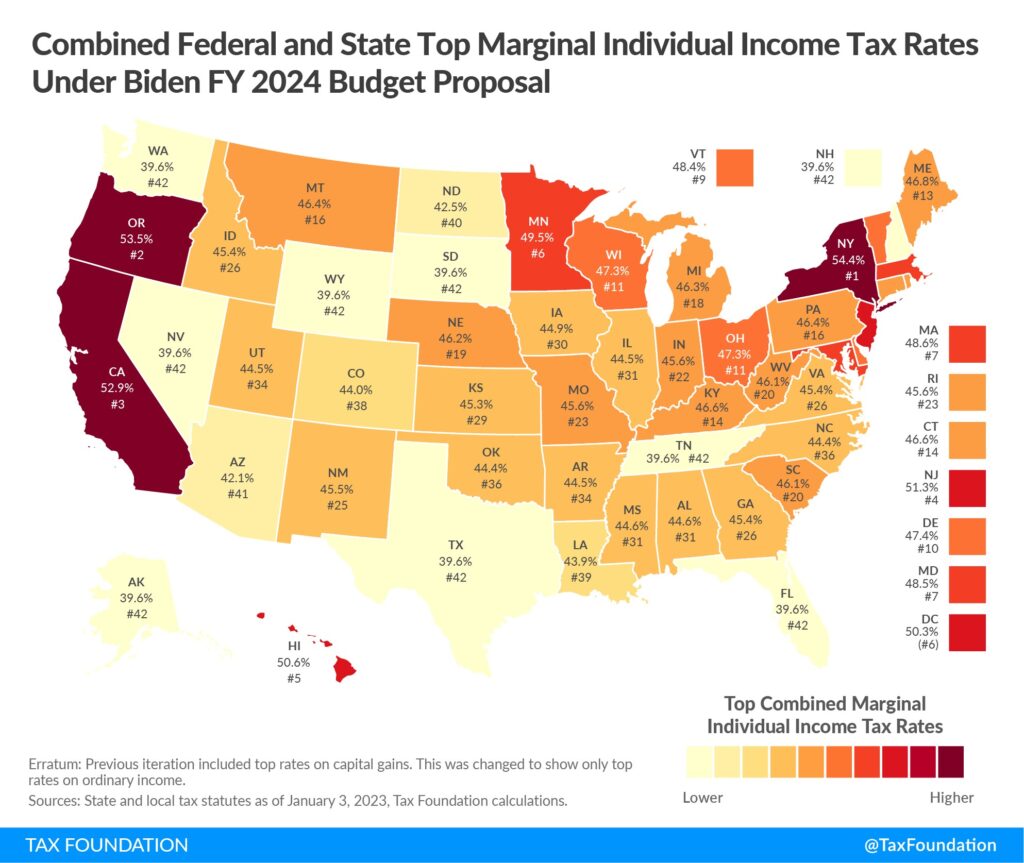

- 2023- A top rate of 39.6% would be applied to taxable income over $400,000 single and $450,000 joint.

- 2023- Qualified dividends and long-term capital gains would be taxed at ordinary income rates, with a top rate of 37% (or 39.6% if the top rate is increased), but only to the extent the taxpayer’s income exceeds $1 million ($500,000 for married filing separately), indexed after 2024.

- 2023 – Impose a minimum tax of 25% on taxpayers with income over $100 million, and requiring recognition of unrealized capital gains in “tradeable assets.” The tax on unrealized capital gains would be available as a credit against future recognition of that gain, to avoid double taxing the same amount. By limiting the tax on unrealized gain in only tradable assets, the required burden and cost of appraisals have been removed from this proposal. Taxpayers can choose to pay the tax in 9 annual equal installments for the first year tax, and for subsequent years in 5 equal annual installments.

- 2024 – Increase the additional 3.8% Medicare tax rate by 1.2% for taxpayers with earnings above $400,000, to bring the total Medicare tax rate up to 5%. The proposal would also increase the net investment income tax rate by 1.2% for taxpayers with income over $400,000, to bring it up to 5%.

- 2024- Make permanent the excess business loss limitation and treat excess business losses carried forward from the prior year as current-year business losses instead of as NOL deductions.

- 2023- Payment of compensation by private foundations to “disqualified persons,” such as family members, would no longer constitute a qualifying distribution that would count toward the foundation’s 5% payout.

- 2024 – Clarify that an IRA owner is a fiduciary for purposes of the self-dealing rules.

- 2024- Require distribution of 50% of the excess balance of IRAs exceeding $10 million, to accelerate income.

- 2024- Limit use of Roth IRAs for high income taxpayers.

- Estate Tax ProposalsThe following reflects an abbreviated summary of some of the most relevant estate tax proposals that may affect the majority of our clients:

- 2023- Expand the definition of “executor” so it applies and imposes responsibility to all taxes.

- 2024- Treat transfers of appreciated property by or on death as a realization even, resulting in recognition of the unrealized capital gain. Cost basis would be stepped up on gift or death, but gain would be recognized, unlike under present law.

- 2024- Shorten the duration of generation skipping tax (“GST”) exemption trusts, which now can go on in many states 1000 years or more. The generation skipping exemption would only apply to (a) direct skips and taxable distributions to beneficiaries no more than two generations below the transferor, and to younger generation beneficiaries who were alive at the creation of the trust, and (b) taxable terminations occurring while any person described above is a beneficiary. The provisions resetting the transferor upon the payment of GST tax would not apply, and existing trusts would be treated as having been created on the date of enactment.

- 2024- Unrealized gains in trusts would be taxed every 90 years.

- 2023- Increase the exception to estate valuation at fair market value from $1.3 million to $13 million for real property used in farming or a trade or business by eliminating the requirement to assess value as highest and best use.

- 2024- Require reporting of trust information for all trusts with a value of $300,000 or more (indexed for inflation), including name of trustee, address, and its GST inclusion ratio.

- 2024- Eliminate “defined value” gifts and transaction that self adjust in the event of IRS audit and a different determination of value.

- 2024- Eliminate the annual per donee gift tax exclusion ($17,000 per donee in 2023) in favor an annual per donor aggregate exclusion of $50,000.

- 2023- Eliminate the ability of grantor’s and grantor trusts to enter into transactions between one another without income tax.

- 2023- Eliminate the ability of a grantor to pay the income tax on grantor trusts without it constituting a gift.

- 2023- Treat loans to beneficiaries of trusts as distributions of the income of the trust. The loan would also constitute a distribution for GST purposes.

- 2023- Require valuation consistency of promissory notes, so that they are not discounted in the estate of the lender.

- 2023- Eliminate valuation discounts associated with closely held businesses, investment holding companies, and fractional interests in property.

- 2023- Curtail valuation abuses through use of charitable lead trusts (“CLATs”) and grantor retained annuity trusts (“GRATs”).

Business, Investment, and Corporate Proposals

The following reflects an abbreviated summary of some of the most applicable business and investment provisions:

- 2024- To treat the exchange of real property similar to sales of real property. However, a taxpayer could continue to defer the gain up to $500,000 per taxpayer ($1 million on a joint return).

- 2024- Tax as ordinary income a partner’s share of income on an investment services partnership interest (ISPI) in an investment partnership if the partner’s taxable income from all sources is over $400,000. This proposal seeks to tax the profit’s interest or capital account carry of a service partner. In addition, partners in such investment partnerships would be required to pay self-employment tax on such income. Finally, the gain on the sale of an ISPI would be ordinary income if the partner is above the income threshold.

- 2023- To require depreciation recapture on the sale of depreciable real estate. This change would not apply to taxpayers with adjusted gross income under $400,000 ($200,000 for married filing separately).

- 2024 – That all trade or business income of high-income taxpayers be subject to the 3.8% Medicare tax, either through the net investment income tax or the self-employment tax. The tax would be phased in at adjusted gross income between $400,000 and $500,000 ($200,000 to $250,000 for married taxpayers filing separately), indexed for inflation.

- 2024 – Special distribution rules on high income taxpayers with large retirement account balances.

- 2023- Increase to 4% the current 1% excise tax on stock repurchases by C corporations.

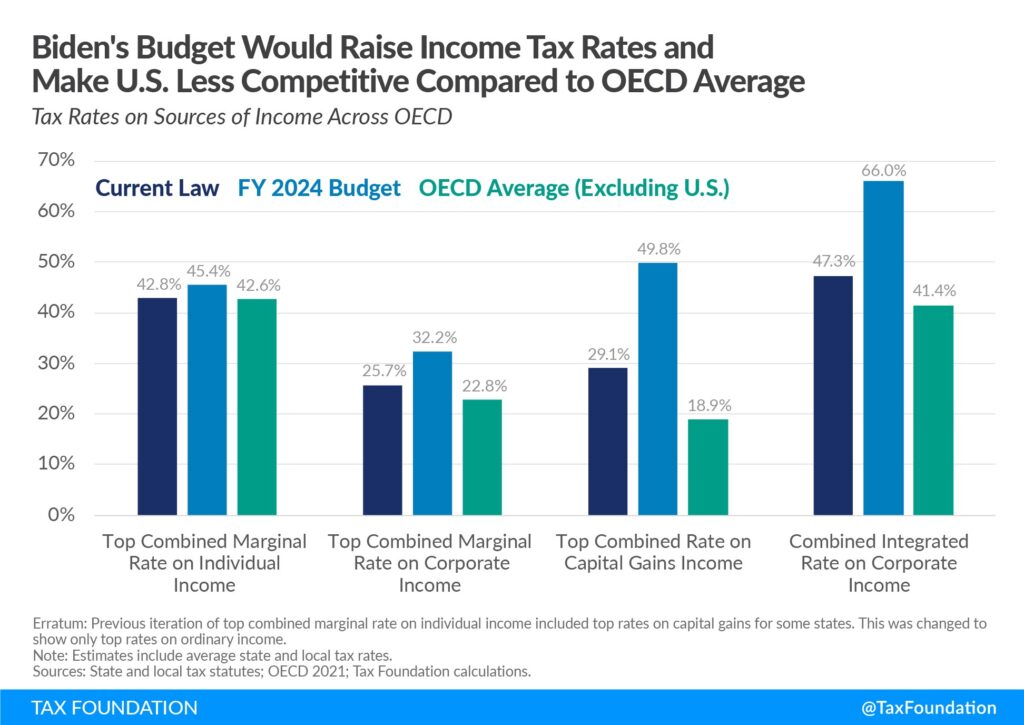

- 2023- Increase the corporate income tax rate form 21% to 28%, making the U.S. less competitive in global competition.