Monthly Econ & Law Update

March 2024

Legal Developments

The Biden Administration released the “Green Book,” with its tax policy desires. As in the prior years of his Administration, increasing taxes on corporations and the wealthy are proposed to support massive government spending. Increased income taxes and taxes aimed at stemming the accumulation of wealth in tax beneficial trusts are proposed. The proposals limit the annual gift tax exemption (presently $18,000 per done) to a maximum annual total amount of $50,000. Furthermore, the proposals do not address the estate tax, leaving rates and exemptions as they currently are and impliedly allowing them to Sunset in 2026, where the projected exemption will be reduced from an anticipated level of over $14 million to just over $7 million- a 50% reduction.

Economic Observations

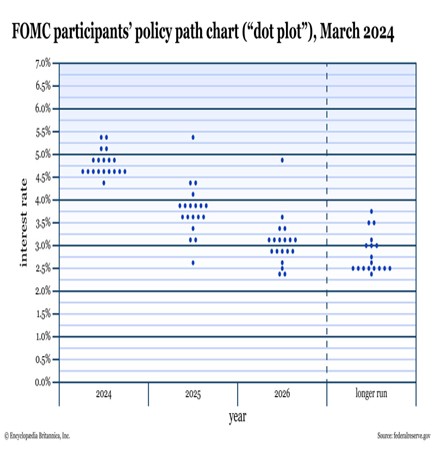

Chair Powell appeared doveish to investors, suggesting that price pressures are easing and that interest rate cuts, though delayed, are forthcoming. Fed officials on their dot plot expect three cuts this year. The Fed tone was warmly received by investors sending equity markets higher, reaching new records. Downward revisions to employment numbers support a slowing economy and this view. Given this is an election year, to avoid an appearance of political influence Powell will likely want strong repeat data to support interest rate cuts.